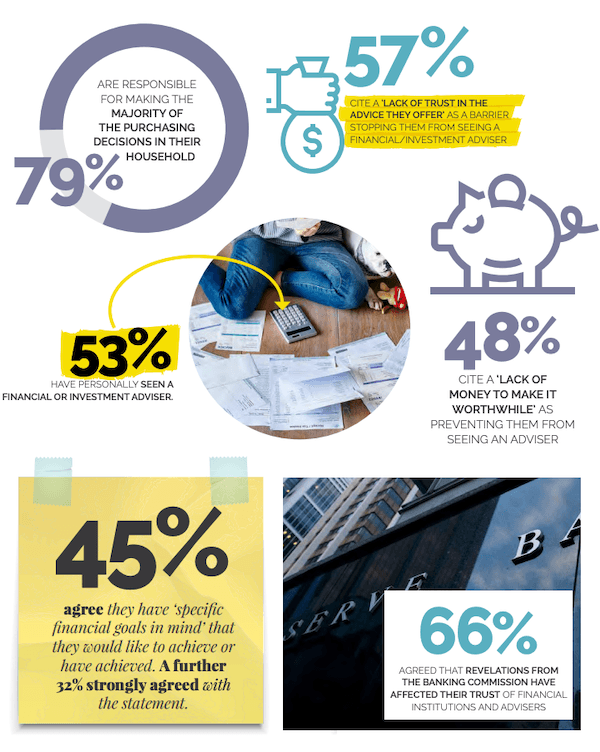

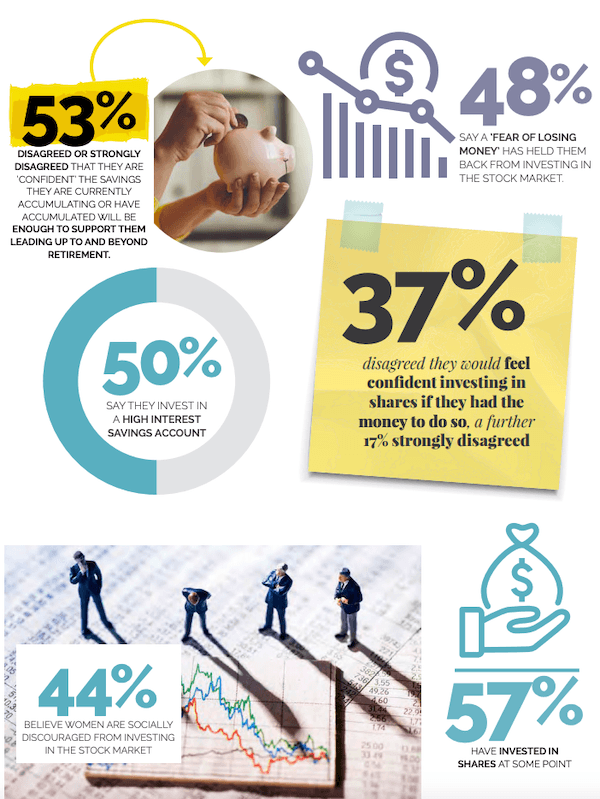

But a number of barriers continue to get in the way of women investing in the stock market — the most notable being a lack of money to invest, along with trust issues and a fear of losing money.

That’s according to the 827 women we surveyed in partnership with Stockspot regarding their thoughts and experiences on investing.

And these barriers still stand in the way despite the good majority of us having specific financial goals — while at the same time sharing concerns regarding longterm financial security.

Women’s Agenda recently ran the online survey in order to determine what (if anything) might be getting in the way of women investing in the stock market, and has written a report on the findings.

While the number one issue was an obvious one — a lack of money to invest — other leading barriers included a fear of losing money, trust issues (especially following the Royal Commission), and a lack of knowledge on how to get started.

These barriers, perceived or otherwise, are concerning, given women are already disadvantaged when accumulating wealth and establishing financial freedom.

It is well documented that the gender pay gap, the motherhood penalty, career breaks, caring responsibilities and long stints of working part time contribute to women falling behind men when it comes to wealth accumulation. It’s also common knowledge that women retire with significantly less superannuation than their male counterparts. Recent research from Rice Warner found men aged 30 to 60 currently have 42 per cent more superannuation than women in the same age bracket — any gaps in investing could signal missed opportunities for women to help bridge this divide.

Future concerns

The female survey respondents appeared well aware of the personal financial risks they may face.

More than half (53 per cent) declared they lacked confidence that the savings they are currently accumulating or have accumulated will be enough to support them leading up to and beyond retirement.

When asked about their biggest financial concerns, a number of worrying trends emerged in the long answers highlighting just how tough many women currently have it in Australia. Some declared they were living week to week, often while sole parenting, while others had suffered unexpected life events such as a death in the family, divorce, disability or a serious career setback such as redundancy; heightening their fears for their financial futures.

Financial expectations

None of this is to say that respondents lack financial ambitions or the nous required to invest. More than three quarters declared they have ‘specific financial goals’ they are looking to achieve or have achieved. We also found that the majority of women hold significant power when it comes to family finances, with four in five (79 per cent) saying they were responsible for the majority of purchasing decisions in their household.

You can access the full report here, but below is a preview of just some of the findings.