Premier Dominic Perrottet made a significant election promise on Sunday to create a dedicated savings fund for each child in NSW to go towards the future cost of a home deposit or higher education.

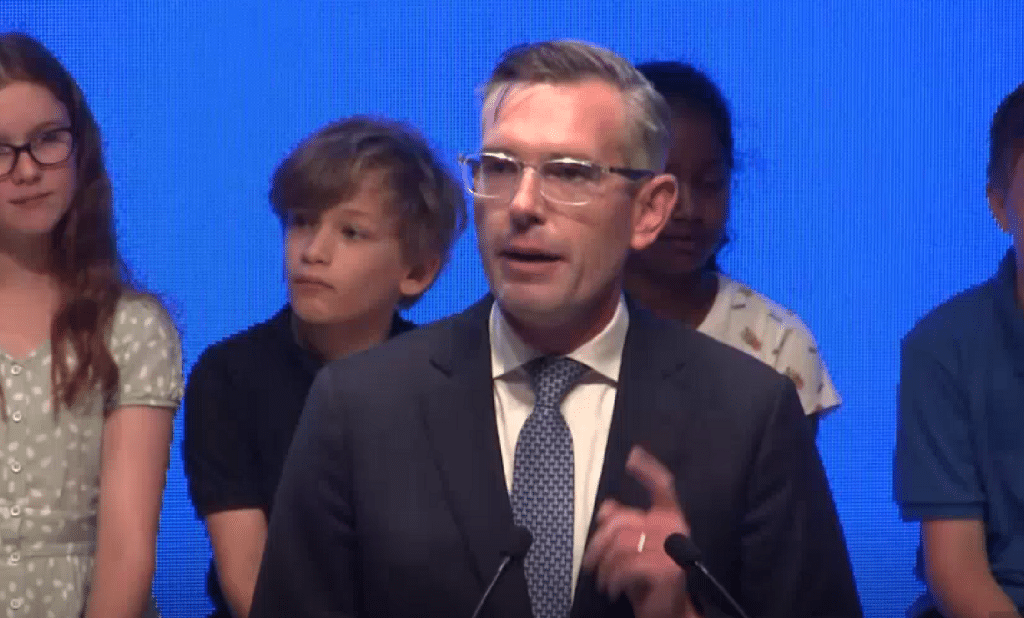

Perrottet made the announcement at the NSW Liberal Party’s campaign launch, positioning the policy promise as “the most significant financial security investment” in the state’s history.

The idea is that a re-elected Coalition government would pay families an initial $400 for every child aged 10 and under into a dedicated savings account, and would then match parents’ future contributions with up to $400 every year until the children turn 18.

According to Perrottet, a child born today could have $28,000 in their accounts by the time they turn 18 if $400 was contributed by their parents each year. If parents contribute $1000 per year, that figure could rise to $49,000.

“This investment will change the lives of millions of children across our state forever,” Perrottet told Liberal Party supporters on Sunday, standing on a stage lined with 36 young children around him.

So who will this policy benefit the most?

With its co-contribution design, the ‘NSW Kids Future Fund’ will disproportionately benefit wealthy children, whose parents have more capacity to put money into the savings account for their children.

Parents who are able to meet the $400 amount each year will be matched at that amount by the government, while children whose parents cannot contribute $400, will only be matched at the lesser amount of what they can contribute.

Amid a cost of living crisis, the policy may further entrench social inequality, benefiting those who are able to contribute $400 per child each year the most.

What should we consider?

The policy is expected to cost $850m over four years, with the money in each child’s account only able to be drawn after they turn 18 and used for a home deposit, HECS debt, textbooks/laptops, private tuition fees or tools for trade.

The policy is not means tested, and risks leaving lower class families and children behind when they are not able to contribute as much to the savings account. For example, a single mother living pay cheque to pay cheque will be much less able to contribute to her children’s savings account than a well-off, dual income family.

For families receiving the Commonwealth Family Tax Benefit A, the government will contribute $200 per year without requiring a co-contribution from parents.

However, shadow treasurer Daniel Mookhey said it will leave families who need the most help with the least to benefit.

“At a time where interest rates are skyrocketing, mortgages are exploding, families don’t have the spare money lying around to put into Mr Perrottet’s bank account,” Mookhey said.

“It seems as though the families that need the help the most will benefit the least from this policy, cause they don’t have the money to put into this account.”

There is also the question of whether the $850 million over the next four years could be spend elsewhere to support children in NSW immediately, rather than at some point in the future when they turn 18.

As Alice Leung, an advocate for teachers and education, wrote on Twitter, “What our children actually need is a government who invests in public schools and ensure they have appropriately qualified teachers for every lesson, every day.”