This Equal Pay Day, new data shows the timeline to pay equality has improved slightly, while a deepening industry divide reminds that there’s still a long way to go.

Falling on 19 August this year, Equal Pay Day marks the 50 extra days into the new financial year that women need to work, on average, to earn the same pay as men. Last year, Equal Pay Day fell on the same day, meaning progress has been stagnant.

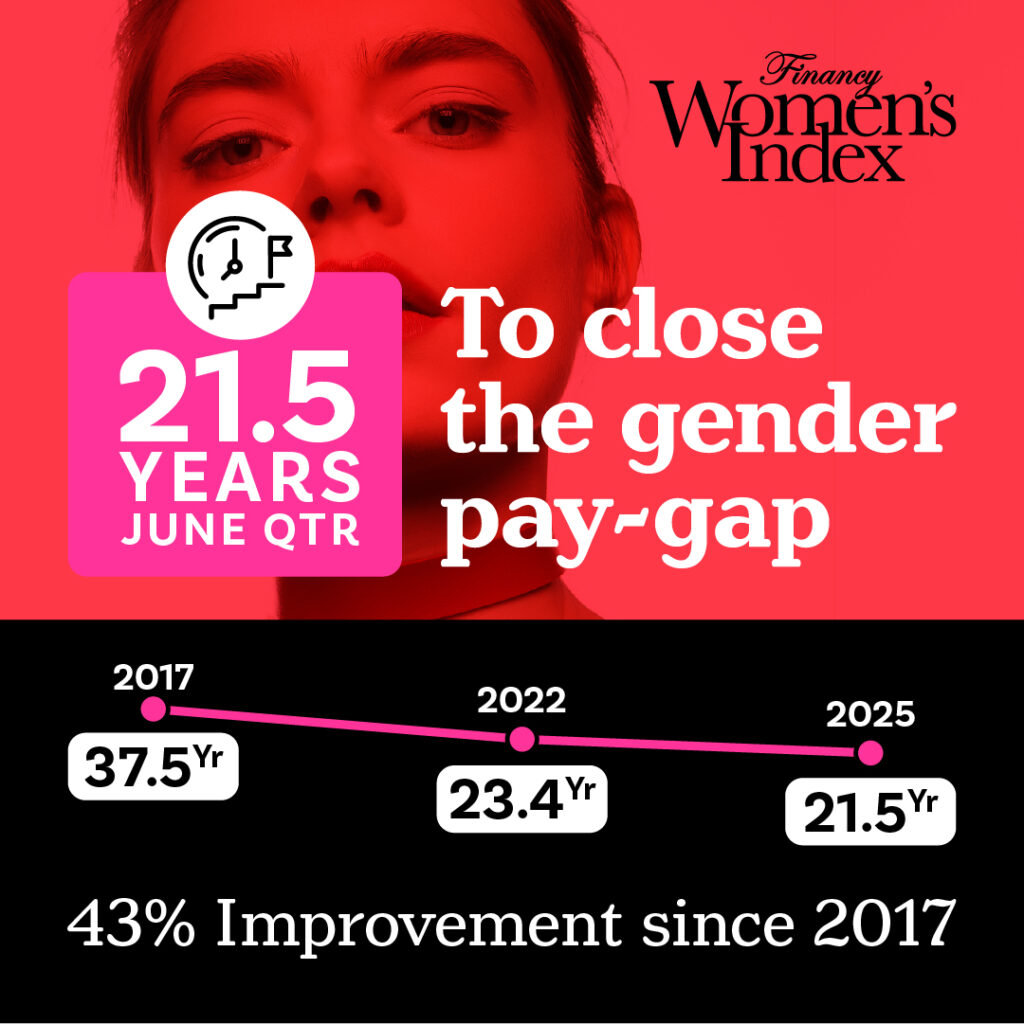

Looking towards long-term indicators, a preview of the upcoming Financy Women’s Index (FWX) report shows the timeline to close the gender pay gap has been cut by 43 per cent since 2017, now standing at 21.5 years compared to 37.5 years previously.

“Equal Pay Day is a stark reminder of the economic reality for women, and our 21.5-year timeframe quantifies the long road ahead,” said Bianca Hartge-Hazelman, author and founder of the Financy Women’s Index.

“While it’s positive to see the number come down over the long term, it represents the median point in a much more complex journey. The fact that women have to work an extra 50 days into the new financial year just to catch up to men’s earnings is unacceptable, and our full report in September will explore the structural barriers holding us back despite record female workforce participation.”

While the pay gap is just one piece of the puzzle, another maker to pay equity is looking at what Financy deems the “two-speed economy”. Their data shows a stark divide emerging between sectors.

A stand out leader, retail trade has narrowed its pay gap by 4.2 percentage points compared to previous years. Whereas, the financial and insurance services sector is moving backwards at an alarming rate, with its pay gap widening by 2.6 percentage points to 21 per cent.

Other sectors that improved their gender pay gap include transport, postal and warehousing (7 per cent gap), as well as manufacturing (9.2 per cent gap).

Meanwhile, the health care and social assistance sector still has the largest gender pay gap at 23 per cent.

“The deterioration in Financial and Insurance Services is a major handbrake on our national progress,” said Hartge-Hazelman.

“It’s this poor performance in key sectors that ensures Equal Pay Day remains a frustrating fixture on our calendar. The full Financy Women’s Index will connect these dots, showing how these laggard industries impact the broader journey to financial equality for Australian women.”

Long-term impact

Research from the Workplace Gender Equality Agency (WGEA) has shown that the gender pay gap is driven by three main things: gender segregation of occupations and industries, unequal distribution of caring and family responsibilities and discrimination in the workplace.

Australian women aged 45-65 are on average $175,000 worse off in retirement due to a range of factors including time out of the workforce and, in some cases, early retirement.

This is driven by a range of factors including that middle-aged women often find themselves caring for children and elderly parents at the same time, as well as experiencing perimenopause and menopause which might see them take a leave of absence from the workforce.

Research by Curtin University, commissioned by Aware Super along with Health Services Union, Health and Community Services Union and Queensland Council of Unions found that 1 in 8 women retire during menopause and 25 per cent would like to due to the challenges they face.

It also uncovered that almost 1 in 5 (17 percent) of Australian women declared taking a long leave of absence from work due to perimenopause or menopause.

This Equal Pay Day, Aware Super is calling for balance through a focus on reproductive leave and visibility that encourages all Australians to stay in the workforce as well as access help, guidance and advice.

“What we know from this research is that the impacts menopause can have on individuals ranges from mild discomfort to symptoms so severe some women are forced to leave the workforce entirely,” said Aware Super’s Group Executive, People & Workplace, Steve Hill.

“We also know that caring duties continue to fall disproportionately to women. The need to take time out of the workforce to care for children or elderly loved ones, is an ever-pressing issue for middle-aged women.”

Equal Pay Day’s call to action

Equal Pay Day is a reminder of the differences in pay and opportunities women and men receive. It’s calculated each year from ABS data, based on the difference between the full-time base salary wages of women and men in the workforce- known as the national gender pay gap.

Data from WGEA shows more than 8 in 10 Australian employers (84.7 per cent) still have gender pay gaps outside the target range of +/-5 per cent.

This year, WGEA has also published a new calculator to help individuals work out their unique Equal Pay Day date for their workplace.

“Every industry in Australia, including those that are women-dominated or that are gender-balanced, has a gender pay gap in favour of men,” WGEA CEO Mary Wooldridge said, noting that this Equal Pay Day is a chance for workplace leaders to take meaningful action on gender equality.

“Recent legislative changes, including publishing individual employer gender pay gaps and to require large employers to select Gender Equality Targets, aim to motivate employers to understand their gender pay gap and take meaningful action to address it,” said Wooldridge.

“Equal Pay Day reminds us that there is still significant work to do to achieve equal and fair workplaces for all people.”

Echoing this sentiment, the president of the Australian Federation of Business and Professional Women, Gillian Lewis described the progress towards closing the gender pay gap as “glacial” and urged for greater action to be taken.

“Australia’s Gender Pay Gap reflects how we value the contribution of men and women in the workforce across our society and within occupations and industries. Closing this gender pay gap is important for Australia’s economic future and reflects our aspiration to be an equal and fair society for all. It is not simple to do – there is no one answer – but we can make change, if we act,” said Lewis.