If your investment approach doesn’t consider gender, race and its impact and effects, your investments may be compromised.

A new report released this month revealed that a failure to implement a gender lens approach could heighten business or investment risk, impacting a company’s operational and share price performance or investor portfolio returns.

The report, ‘A Roadmap for Australian Investors – How to invest to achieve gender equity, racial equity, diversity and inclusion’ — aims to help investors adopt gender lens investing (GLI) to improve operational and investment performance, uncover investment opportunities and reduce risks while contributing positively to gender and racial equity, and diversity and inclusion outcomes.

The report was published by Capital Human and Impact Investing Australia and includes roadmaps for investors, including asset owners, fund managers, wealth managers, family offices and foundations, offering practical steps to strengthen a gender lens approach to investing.

The guidelines outline how investors can effectively integrate gender into their investment frameworks and decision-making processes, using a “3i Framework” which includes:

1. Internal operations: Considering gender within an organisation’s governance, policies, people and processes

2. Investment processes: Considering gender within investment processes

3. Influence on system: Noting how an investor can use their influence to achieve gender equality beyond their own core work.

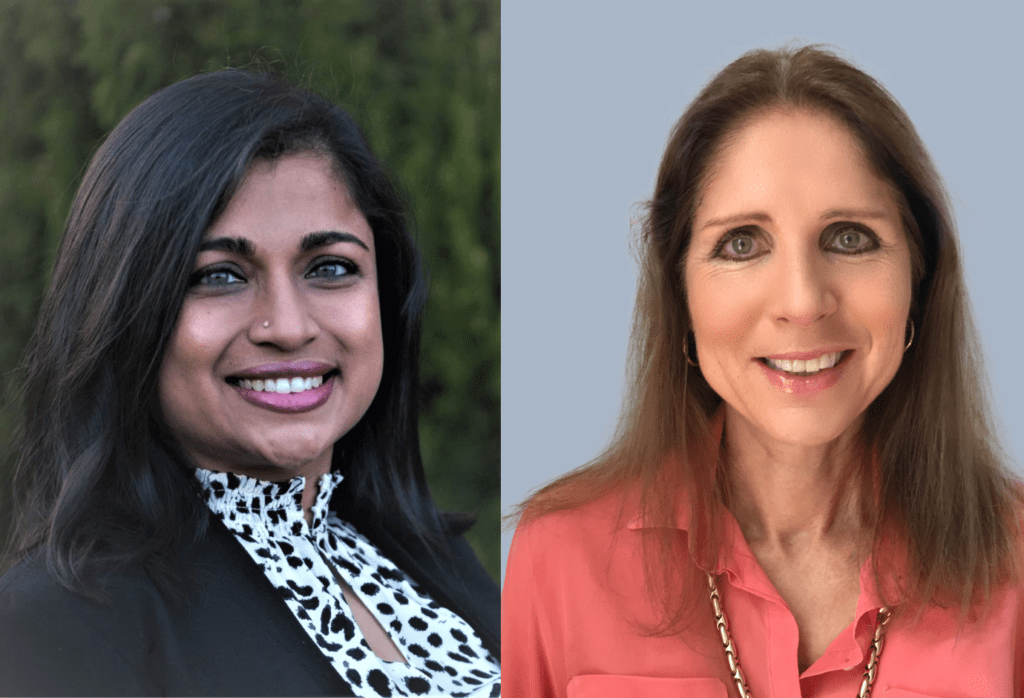

Sally McCutchan, co-author of the report, said that findings revealed that: “integrating an approach that considers gender and racial equity limits investment opportunities and increases investment risk.”

“In fact for GLI done properly the opposite is true,” McCutchan, the Executive Director at Impact Investing Australia, said.

“Our report demonstrates there are many paths to improving gender, diversity and importantly inclusion outcomes across internal organisational structures and policies, investment processes and through influencing systems.”

“We wanted to provide investors with easily implementable roadmaps and a framework to get them started or to strengthen their GLI approach from whatever point they’re at.”

The research found that companies in the top quartile of gender diversity in executive teams were 21 percent more likely to outperform the market on profitability, and 27 percent more likely to have greater value creation.

Companies in the bottom quartile were found to be 29 percent more likely to underperform the market on profitability, while private equity and venture capital funds in emerging markets.

Gender-balanced senior investment teams generated up to 20 percent higher returns compared with other funds.

Meanwhile, top quartile companies with a culturally diverse team were 33 percent more likely to outperform on profitability, while those in the other three quartiles were 29 percent more likely to underperform.

Co-author Manita Ray believes that systemic change is needed if Australia is to pursue a more active role in closing the gap toward gender equality in Australia.

“Direction of capital and investment are powerful levers for change and gender lens investing is a strategy that can enable this,” Ray, Founder and CEO at Capital Human said.

“What the report shows is that intentionally directing capital and purposefully considering gender and diversity throughout the investment process can lead to better financial returns, now and into the future.”

“It supports investors to discover additional paths towards a gender equitable world through the power of inclusive, sustainable investment.”

You can read the report here.