Australia’s gender pay gap of 21.7 per cent is not good, but it’s far from the whole story for women.

Why? Because starting from a $0 base masks the real impact on women.

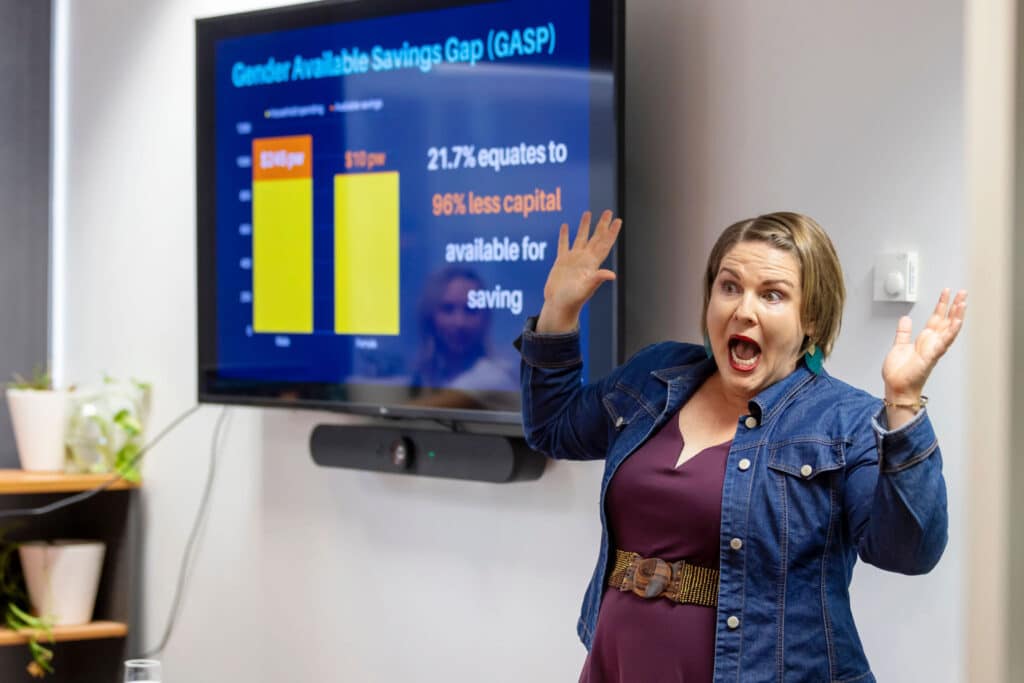

What really matters is something I’m calling the Gender Available Savings Penalty or GASP, and you may GASP when I explain what it is.

The Gender Available Savings Penalty gap is actually 96 per cent.

Let me explain…

The baseline should be taken from basic cost of living, not $0.

Take the average working man and woman.

He’ll earn around $1,390 a week. She’ll earn around $1,092 a week.

Take out income tax and they’re left with $1,122 and $887 a week respectively in their pockets.

Now, take out average household spending of around $877 a week (I’ve CPI’ed the FY16 ABS data to get that figure since there hasn’t been a new release).

That’s right. Those living costs are the same. There’s no gender discount on your rent or groceries, and no reduced income tax brackets. If anything, I suspect women get the short straw here given how companies commonly pinkify a product then charge women more for it (Future Super versus Verve Super anyone? I digress…)

The point is that he is left with $245 a week of available savings after household spending. While she is left with $10. A measly 4 per cent of what the average man has available.

What does a 96 per cent GASP mean for women?

This means men can, on average, save at 24 times the rate of women.

Men can save an order of magnitude faster for things like a house deposit, buying shares, and making voluntary contributions to superannuation.

It means women will take 24 times longer to save enough capital to bootstrap a business, or accumulate matched funding for a coveted grant.

They’ll take 24 times as long to recover from draining their buffer fund in the event of a financial mishap.

This is why I rail against having “skin in the game” for female founders. Specifically, it’s why I’ll continue to shout down any venture capitalist who wants a woman to mortgage her home before they’ll invest.

It’ll take her 24 times as long as her male peers to save the deposit for the next home if it all goes to pot, sir! And it’s usually a ‘sir’ I’m shouting at, of course.

That available savings is the money that we all need to get ahead in life. To cushion ourselves from financial shocks via a buffer fund, to invest so we have a nest egg when we can’t work anymore, to bootstrap that brilliant idea so we can change the world.

If we’re serious about investing in women as this years IWD “Count Her In” theme suggested, we need to make it feasible for women to invest for themselves too.

What do we tend to do instead?

We put the onus back on women to make do with less.

Haven’t got enough to save? So often, women are blamed. We’re clearly spending too much on your hair, makeup, and I don’t know …basic sustenance. Cut out the luxury goods and services!

For example, the ‘experts’ say we ought to be reusing our teabags.

I kid you not. That was tip number 290 of 315 of the Super Woman Money Program run by VicSuper in 2017 to help women “get financially fit in five weeks,” so we don’t retire into penury.

(If you want to see a case study in the YOUR FAULT approach you can check out the other 314 tips, now only available via the Wayback machine as they have at least had the decency to take the page down.)

If we dare to look at the other side of the equation – earning more – we’re told we didn’t get that pay rise because we’re not confident enough. That’s despite the ‘you don’t ask’ myth being thoroughly debunked (women ask for pay rises as often as men but are knocked back more frequently.)

Fortunately, there is a solution to the GASP.

Close the gender pay gap.

I love Financy’s gender equality tracking via their Women’s Index, but here’s the thing:

We’re actually only one year away from closing the nation’s gender pay gap if we really, really wanted to. If we were willing to pay what it takes, because we believed it was time to fix this problem once and for all and we simply could not tolerate another year of unfairness.

In the words of the incredible champion for equality, former Sex Discrimination Commissioner Kate Jenkins AO:

“Change does not take time. It takes action.”

And yes, those actions are not small in some cases. My gosh, there are some whopping gaps in the 27 February WGEA private companies release. Some of you have a lot of homework.

You’d probably need to add roles – and place women in them – at several levels of the organisation. (Maybe companies need a budget line item titled ‘Salaries we must now pay because we haven’t maintained our talent pipeline.’)

You’d need to hunt down and eliminate places where the motherhood penalty applies. Then, you need to make the workplace inclusive by ensuring women are present, in force, in every decision-making forum. Every employee would need to help make women feel safe by standing up and saying something when they witness a woman being bullied, discriminated against or harassed.

But don’t let that daunt you. You know what needs to be done. And ultimately, employers: your lack of action is hampering your female employees’ ability to save and invest. To live a stable, secure life.

Time to get it done, folks.

Close the pay gap, stop the GASP and Count Her In to the world of saving and investing.

Pictured above: Lacey Filipich pictured at the UN Women event last week for IWD. Photo by Kelly Pilgrim-Byrne.

Lacey Filipich is a financial educator, founder, speaker, chemical engineer and the international award-winning author of Money School. She recently spoke at a UN Women’s International Women’s Day event.