If the goal of family payments is to boost women’s workforce participation, we have a big problem because we are now spending $32 billion a year and we’re getting very little in return.

A report released today by the Centre for Independent Studies called Complex Family Payments indicates the growing amount of money spent on family payments is inefficiently spent because of poor program design. The report author Trish Jha says the complicated payment system and increasing costs of childcare act as disincentives to families working to the extent they would like.

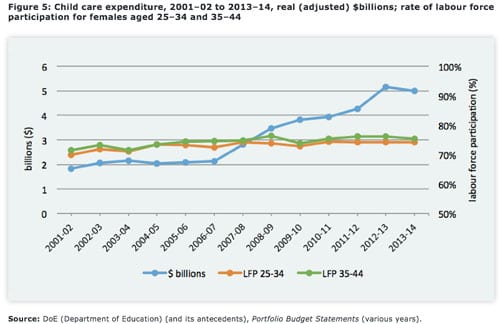

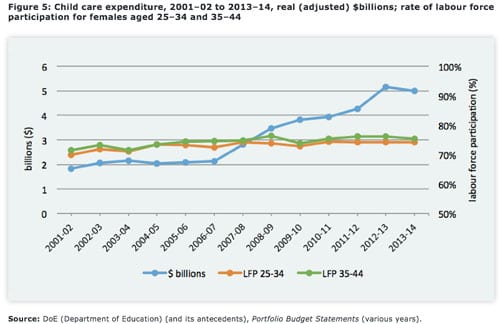

According to the report government spending on family payments has increased from $23 billion in 2003-04 to $32 billion in 2013-14 in real terms but this has garnered very little change in women’s workforce participation.

‘The government should take the opportunity to fix the anomalies in the family payments system which keep some women at home when they would prefer to work or expand their working hours,” Jha says. ‘Women working less than they would like has worrying long-term consequences including lower retirement income and loss of financial security.”

Jha argues that overhauling the system would enable families to more easily compare the financial benefits of their work and life choices.

“The federal government should act now to fix the problems in the family payments system and make it easier for parents to make decisions about returning to work when they have young children,” Jha says. “My message to the government is: Reform family tax benefits to include simpler income tests for Family Tax Benefit Part A, supplement personal tax cuts, and reduce barriers in child care. The Productivity Commission’s review into child care is a positive step but the government should reframe child care as a workforce participation measure and reduce the regulations in the system to free up access.”

Rather than investing in its proposed paid parental leave policy Jha urges the government to focus on the bigger picture. “Recent budget changes tinkered around the edges with family payments, but the government has not done nearly enough to fix structural problems. Families still face cumulative reductions in Family Tax Benefit, reductions in Child Care Benefit, and higher rates of income tax when they return to work or take on additional hours.”

If the government is serious about getting women back into the labour force after they have children, this is the problem to tackle.