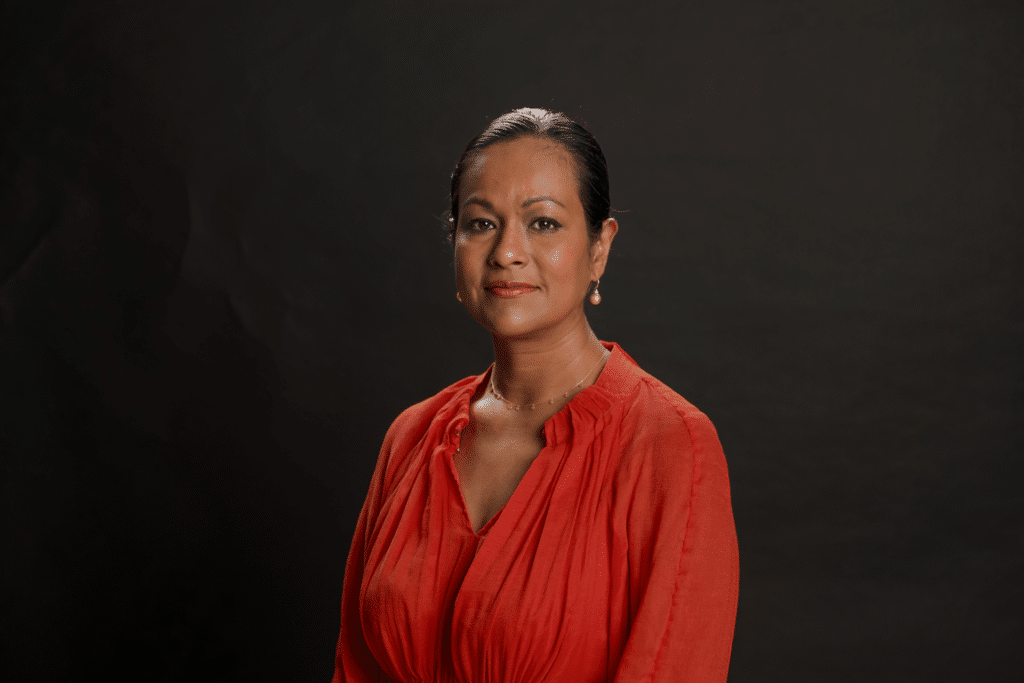

Partner and Head of Financial Services Tax at Grant Thornton, Himashini Weeraratne has always been a changemaker no matter what industry she worked in her career.

“I actually did law back in the day,” says Weeraratne, “And why I did law was to become a change-maker.”

“I loved tax, and obviously tax is an amalgamation of law, accounting, and commerciality of all principles. Then I fell in love with superannuation.”

Weeraratne has over 20 years of experience providing tax advisory and compliance services to financial service providers, fund managers, managed funds, superannuation funds and their advisors.

Now at Grant Thornton, she says that superannuation has captured her heart for its ability to give the best back to its members, particularly women.

“Research shows that women live longer than men, which can be a challenge. Living longer means that what you saved might not be enough for the future,” Weeraratne says.

To mitigate this, she suggests that women consider working longer and evolving into different careers to maintain longevity in their super balance.

“Planning for longevity is crucial,” she says, adding that women need higher super contributions for their longer lifespans and should seek professional advice as well as stay informed about legislative changes that could impact their super contributions.

“Recent changes like catch-up payments on concessional contributions and caps are significant and should be understood,” she says.

All of this is especially important as women in Australia are more likely to take career breaks and work part-time, which can impact their ability to grow their superannuation balance.

“To mitigate this, consider returning-to-work programs or part-time work programs,” she says, noting that “part-time employment can also impact your superannuation savings, so it’s important to upskill yourself or negotiate better positions to enhance your retirement savings.”

The gender pay gap is, unfortunately, another factor that can have a massive impact on women’s superannuation savings.

Weeraratne says that to “circumvent this, it’s a responsibility not just on us but also on employers and the government.”

“We need to lobby for policies that enable higher super guarantee rates and advocate for employer contributions, as well as tax incentives for women who work part-time or have career breaks,” she says, as these “proactive steps” can help better retirement strategy and future savings for all women.

Every woman in Australia should keep in mind to start early and start small when it comes to superannuation savings, Weeraratne advises.

“Early savings significantly contribute to your super going forward,” she says. “Start saving consistently, and during career breaks, get help from your spouse or partner to support your contributions.”

It’s also important to achieve small, measurable goals and to educate yourself about investment options by talking to the right advisors. One way to do this is by taking advantage of employer contributions and government co-contributions if you are a low or middle-income earner, she adds.

Preparing for unexpected events is another piece to this puzzle, as Weeraratne says “the pandemic taught us the value of being aware of income protection policies and TPD insurance, which support you when needed”.

And finally, Weeraratne advises women to network and advocate for themselves.

“Find women like yourself to network with and educate yourself about available benefits and incentives. Finance and superannuation are complicated areas, so proactive steps, networking, and joining advocacy groups can help you navigate this complex world.”