When we talk about the gender pay gap, what we’re really trying to talk about are gender-based barriers to financial security. These barriers are largely to do with wages, but incorporate other factors, like the ability to reduce or remove housing stress, care for dependents and provide for times when we cannot earn cash income.

Discussions about the gender pay gap therefore, are NOT about demanding extortionate wages for all women. No one is suggesting that becoming the CEO of a Fortune 500 company is a basic human right.

But we do need to know if women are disproportionately living in poverty, if this is occurring simply because they are women, and if so, what can be done to change it.

If the evidence shows that women are significantly less likely to achieve financial security than men, then it’s not enough to say that Australia has legislated equal pay and therefore nothing more needs to be done.

The reasons for gendered disparity of financial security are far less tangible than every job ad coming with a “white middle class men only” disclaimer.

The issues we need to examine are complex and the only way to get a proper grip on them is to start with the big picture, break it all down into the granular details and them build them all back up again into a clearer version of the big picture.

So the pay gap seems to be the most obvious way to start.

We know the pay gap exists and most of us probably know that it’s somewhere around 18%, but it’s not always easy to know exactly what that figure means. We can be fairly sure that it doesn’t (usually) mean that men are being paid 18% more that women for doing exactly the same work, so where does it come from?

The 18% figure (18.6% to be strictly accurate) is the difference between the total average weekly cash earnings of adult, full time males and females, expressed as a percentage of the average male earning. The data is from the Australia Bureau of Statistics average weekly earnings catalogue for Nov 2014.

The data is assembled by surveying around 5,000 Australian businesses and is updated every six months. Like any survey data, it needs to be treated with some caution. But where the results are echoed in similar studies using different data (as is the case here) we can be reasonably confident in its accuracy.

In November 2014 the average full time cash earnings for an adult man was $1587, for a woman it was $1292, a difference of $489, which is 18.6% of the male earnings.

Another way to look at it is that the average male earnings are 22% higher than female earnings.

To break it down a bit, there’s a few key points that are included and excluded in that 18.6%:

- It does not take into account the number of women earning above or below the average as opposed to the number of men,

- It only includes data from full time workers,

- It includes paid overtime,

- It excludes anyone being paid as a junior,

- It’s the average across all industries and the variations, even within industries, can be more than $1,500 per week,

- It does not include non-cash benefits such as share options, fringe benefits etc, and

- It does not describe gendered access to high paying industries.

So, it’s a useful indication of what’s happening at a macro level, but the devil, as always, in in the details, and when we look at the details, 18.8% starts to look really good.

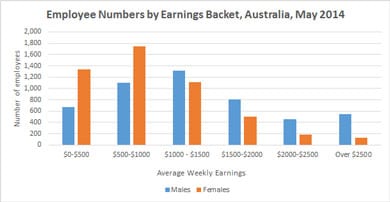

This is a slightly different data set collected by the ABS, the Employee Earnings and hours data, the most recent release is for May 2014.

If we look at the total cash earnings of all employees (including part time and casual staff) the average weekly cash earnings for men in May 2014 was $1430, for women it was $940. In other words, total average male earnings are 52% higher than female earnings.

Why do we assume that the only way to talk about the gender pay gap is to compare full time earnings? If women are so disproportionally represented outside the full time earning category then isn’t that relevant to the pay gap discussion? And, in that case, isn’t it time that we started talking about the pay gap being more than 50% in Australia?

When we start drilling down a little bit, and consider how many women are earning above average salaries compared to men, without going into too granular details, the differences are immediately obvious.

This graph shows the number of males and females whose average total weekly earning fall within a $500 range. The breakdown of the numbers also looks like this:

But again, this is still very much at the larger end of the data. To get a better view of how this works, we need to look at what happens inside various industries and how the jobs and wages are distributed between men and women – which will be the subject of the next article in the series.

Note:

You may have read my introductory piece on Monday, in which I described the series of articles Women’s Agenda have planned for the next few months. We are going to take an in-depth look at the two most significant issues disadvantaging women in Australia – poverty and violence. This is the first article in this series, and we’re starting with the gender pay gap.

As I said in the introductory piece, we at Women’s Agenda very much want this series to be a collaborative exercise. So I am making all the spreadsheets including all my calculations, available for download. I leave the original data sheet alone and either copy or link in subsequent sheets for the calculations. I also include the ABS reference numbers and links to the download site.

Please don’t hesitate to get in touch if you find something more in this data that you think should be included. If there are other data sets on the ABS site that I haven’t mentioned yet, you can be very sure that I will get to them later.